|

Introduction to the measurement of interest rate risk (Reading 59)

|

||||||||||||||||||||||

|

Exercise Problems: |

||||||||||||||||||||||

|

1. A fixed income security’s current price is 101.65. You estimate that the price will rise to 102.98 if interest rates decrease 0.25% and fall to 100.91 if interest rates increase 0.25%. The security’s effective duration is closest to: A. 3.98 B. 4.07 C. 4.87 |

|

Ans: B; B is correct because the effective duration =(Bond price when yield falls-Bond price when yield rises) / (2 × Current price × Change in yield in decimal) =(102.98-100.91)/(2 ×101.65×0.0025) =4.07

|

||||||||||||||||||||

|

2. Amy Lee, a fixed income analyst gathers the following table with the yields and corresponding prices for a hypothetical 10-year option-free bond which initially yields 8%:

Using a 10 basis point rate shock, the duration of this bond is closes to: A. 8.78 B. 17.56 C. 4.39

|

|

Ans: A; Effective duration =(Bond price when yield falls-Bond price when yield rises) / (2 × Current price × Change in yield in decimal) =(100.8454-99.0901)/(2 ×100.00×0.001) =8.78 |

||||||||||||||||||||

|

3. An 8%, semiannual pay, option-free bond that is trading at par is maturing in 8 years. The effective duration of the bond based on a 50 basis point change in rates is closest to: A. 3.9 B. 4.0 C. 5.8 |

|

Ans: C; First calculate the bond’s values at 7.50% and 8.50% yields to maturity. N=16, I/Y=7.50/2=3.75, PMT=4, FV=100 CPT PV=-102.97 N=16, 1/Y=8.50/2=4.25, PMT=4, FV=100 CPT PV=-97.14 The bond values are $102.97 and $97.14 respectively. Therefore duration =(102.97-97.14)/(2 ×100×0.0050) = 5.83

|

||||||||||||||||||||

|

4. Bond 1 has an effective duration of 3.7. If the bond yield changes by 100 basis points, the price of the bond will change by:

A. approximately 0.37%. B. approximately 3.7%. C. exactly 0.37%.

|

|

Ans: B; B is correct because the change in price due to a change in yield in only approximate because the calculation of effective duration does not reflect convexity. It is a linear approximation of a non-linear relation. |

||||||||||||||||||||

|

5. If three bonds are otherwise identical, the one exhibiting the highest level of positive convexity is most likely the one that is: A. option-free B. callable C. putable

|

|

Ans: C; C is correct because when interest rates rise, a putable bond is more likely to be put back to the issuer by the investor, limiting the loss of value and giving the bond more positive convexity than an option-free bond. B is incorrect because a callable bond is likely to be called from the investor when interest rates fall, limiting the gain in value and giving the bond negative convexity. |

||||||||||||||||||||

|

6. Lisa Ying manages a fixed income portfolio of three bonds as shown in the following table. The duration of her portfolio is closest to:

A. 9.24 B. 9.60 C. 28.81

|

|

Ans: A; The market values of the bonds (Price×Par Amount) are respectively Bond A: 110.3412/100×10,000,000=$11,034,120 Bond B: 101.4835/100×5,000,000=$5,074,175 Bond C: 86.2746/100×8,000,000=$6,901,968 They sum up to a total portfolio value of $23,010,263. Therefore, the duration of the portfolio = (11,034,120/23,010,263×7.39)+ (5,074,175/23,010,263×9.21)+ (6,901,968/23,010,263×12.21) =9.24

|

||||||||||||||||||||

|

7. The most relevant description for duration is: A. the first derivative of value with respect to yield. B. a security’s price sensitivity to yield changes. C. the weighted-average time until receipt of the present value of cash flows. |

|

Ans: B; B is correct because bond investors are interested in a security’s price sensitivity to changes in yield, and duration is a good measure of this interest rate risk. |

||||||||||||||||||||

|

8. A bond has duration of 5.4 and convexity of -41.30. If interest rates increase by 0.5%, the percentage change in the bond’s price will be closest to: A. -2.85% B. -2.80% C. -2.75% |

|

Ans: B; B is correct because when convexity is known, the percentage change in a bond’s price = (-duration × Δy × 100) + (C × (Δy) 2 × 100) = (-5.4×0.005×100)+(-41.30×0.0052×100) =-2.80

|

||||||||||||||||||||

|

9. If a bond has a modified duration of 14 and a convexity of 70, the convexity adjustment ( to a duration-based approximation) corresponding to a 50 basis point interest rate decline is closest to: A. -0.175% B. 0.175% C. 0.0075% |

|

Ans: B; Convexity adjustment to percentage change in price(%ΔP) =Convexity measure × (Δy) 2 × 100 =70×(-0.0050) 2×100 =0.175% Therefore B is the correct answer.

|

||||||||||||||||||||

|

10. David Zhao, a fixed-income analyst, determines that a 6.8% coupon option-free bond, with 7 years to maturity, would fall 2.5% in price if market interest rate rise by 0.5%. If market interest rates fall by 50 basis points, the bond’s price would climb by: A. less than 2.5% B. exactly 2.5% C. more than 2.5% |

|

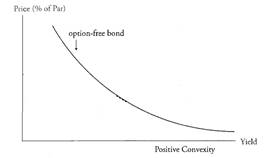

Ans: C; The bond is option-free and will therefore exhibit positive convexity, which means an equal change in rates will produce a greater percentage gain when rates decrease than the percentage loss produced when rates increase.

|

||||||||||||||||||||

|

11. Lei Lee makes the following statement about putable bonds: As yields rise, the price of putable bonds will fall more quickly than comparable option-free bonds (beyond a critical point) due to the decline in value of the embedded put option. Meimei Han adds that as yields fall, the price of putable bonds will climb more quickly than comparable option-free bonds (beyond a critical point) due to the increase in value of the embedded put option. Are their statements about putable bonds correct? A. Neither statement is correct. B. Both statements are correct. C. Only one of the statements is correct. |

|

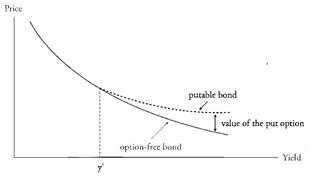

Ans: A;

Lei Lee is incorrect because as yields rise, the value of the embedded put option in a putable bond increases and reduces the decline in the value of the bond compared with a similar option-free bond. Meimei Han is incorrect because as yields fall, the value of the embedded put option decreases, and the putable bond behaves much the same as a similar option-free bond since the embedded put option has little or no value.

|

||||||||||||||||||||

|

12. Jim King makes the following statement about callable bonds: As yields rise, the callable bond behaves much the same as a comparable option-free bond. Kate King adds that as yields fall, the price of callable bonds will rise less quickly than comparable option-free bonds (beyond a critical point). Are their statements about callable bonds correct? A. Neither statement is correct. B. Both statements are correct. C. Only one of the statements is correct. |

|

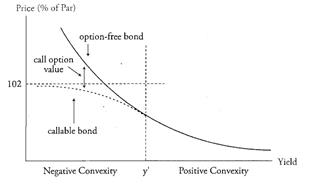

Ans: B;

As indicated by the graph above, both Jim and Kate’s statements are correct. Therefore B is the correct answer.

|

||||||||||||||||||||

|

13. Which of the following is a shortcoming of the full value approach to measuring the interest rate risk of a bond portfolio, compared to the duration/convexity approach? A. It ignores the impact of embedded options. B. It is relatively time consuming. C. It cannot be used for stress testing. |

|

Ans: B;

B is correct because the full valuation approach is relatively time consuming, especially if some of the bonds have more complex structures.

A is incorrect because the full value approach does not ignore the impact of embedded options. It just gets quite complex and time consuming for bonds with embedded options. C is incorrect because the full value approach can be used for stress testing a bond portfolio, for situations with extreme changes in interest rates.

|

||||||||||||||||||||

|

14. Which of the following is an advantage of the full value approach to measuring the interest rate risk of a bond portfolio relative to the duration/convexity approach? A. less time consuming. B. easier to model. C. more accurate. |

|

Ans: C;

C is correct because *Full valuation approach: Advantage:

Disadvantage:

*Duration/convexity approach: Advantage: simplicity. Disadvantage: the duration-convexity approach is appropriate only for estimating the effects of parallel yield curve shifts.

|

||||||||||||||||||||

|

15. Bond A is now trading at 97.384 with 8 years to maturity and a YTM of 5.38% and duration of 6.45, its price value of a basis point (PVBP) is closest to: A. 0.0524 B. 0.0628 C. 0.0779 |

|

Ans: B; The duration multiplied by one basis point (0.0001) multiplied by 100% is the percentage change in value of the bond for a one basis point change in interest rates. PVBP is the price multiplied by the percentage change in value for a one basis point change in interest rates. Therefore PVBP= 97.384 × 6.45 × 0.0001 ×100% = 0.0628

|

||||||||||||||||||||

|

16. Bond B is currently trading at 1,015 with an effective duration of 6.88. If the market interest rate fell by 25 basis points, the new price would be closest to: A. $998 B. $1,015 C. $1,032 |

|

Ans: C; Because the market interest rate falls, the change would be positive. The change in price would be 6.88 × 0.0025= 0.0172 The new price= 1,018 × (1+0.0172)= $1,032

|

||||||||||||||||||||

|

17. Changes in a bond’s cash flows associated with yield changes would be reflected in the bond’s: A. modified duration B. Macaulay duration C. effective duration |

|

Ans: C; C is correct because effective duration captures the effects from changes in a bond’s cash flows when the yield changes. Therefore, effective duration is the appropriate measures of interest rate sensitivity for bonds with embedded options ( changes in cash flows). A is incorrect because modified duration is calculated without any adjustment to a bond’s cash flows for embedded options. B is incorrect because Macaulay duration is frequently used by portfolio managers who use an immunization strategy and is irrelevant in this case.

|

||||||||||||||||||||

|

|

|

|

||||||||||||||||||||